Table of Contents

With a record-high total value locked (TVL) in its platform and fees, Jito, the largest liquid staking project on Solana, is performing well.

Data on its website indicates that Jito Jito jto -6%

Jito has a TVL of $2.7 billion, or 14.6 million SOL. With this volume, it ranks third in terms of liquid staking protocol after Lido and Binance Staked ETH, and it is the fourteenth largest player in the decentralized finance sector.

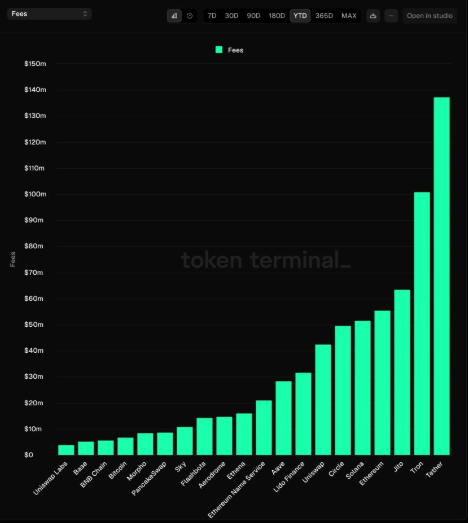

This year, Jito is outperforming Uniswap, Ethereum, and Solana.

In addition to flipping Solana Solana sol -1.15%, Ethereum eth -1.7%, and Uniswap in fees made this year, Jito has around 150,000 users.

TokenTerminal reports that Jito has made $63 million in fees so far this year, while Ethereum has made $55.1 million. The earnings for Solana and Uniswap Uni are $51 million and $42.1 million, respectively.

After Tether and Tron, which have earned $137 million and $100 million, respectively, Jito is now the third cryptocurrency project in terms of fees this year. Additionally, it has emerged as the DeFi industry’s most lucrative participant. Additionally, its fees are greater than those of Lido Finance, the largest liquid staking platform with $31 million in revenue so far this year.

Additionally, it has earned $559 million in fees over the past 180 days and $729 million over the past 12 months.

After dropping to $2.25 million in December from an all-time high of $14.1 million in November, Jito’s daily fees have now recovered.

Jito provides two primary options.

Jito provides liquid staking and restaking to its customers. Users that participate in liquid staking move their staked tokens to the network and exchange them for JitoSOL, also known as an LST.

Because the LST is a liquid token, holders can trade and use it in DeFi protocols, in contrast to the conventional staking method. Jito claims that the average Solana staking yield is 7.4%, while the current yield of staked LSTs is 9.81%.

Restaking, a service that tokenizes staked assets as Vault Receipt Tokens, or VRT, has also been created by Jito. Over time, restaking enables owners of staked assets to increase their returns. The total locked value of Jito’s restaked tokens is $42.6 million.

However, since its 2023 airdrop, Jito’s token has not done well. On January 12, it was selling at $2.64, 40% lower than its peak in December and 50% lower than its peak of $5.3.

Since 11.31 million JTO tokens will be released monthly until December 2026, the network’s regular dilution is the cause of this performance. With a supply cap of 281 million, there are now 281 million JTO tokens in use.

FAQ

Jito is the largest liquid staking project on the Solana blockchain. It is significant because it has achieved a record-high total value locked (TVL) of $2.7 billion and generated $63 million in fees this year, outperforming major players like Ethereum, Solana, and Uniswap in terms of revenue.

Jito provides two primary services:

- Liquid Staking: Users stake their tokens and receive JitoSOL (an LST) in return, which can be traded or used in DeFi protocols. The staking yield for JitoSOL is currently 9.81%.

Restaking: Jito tokenizes staked assets as Vault Receipt Tokens (VRT), enabling users to earn additional returns.

Jito ranks as the third-largest liquid staking protocol globally, trailing only Lido and Binance Staked ETH. In terms of fees generated, Jito has outperformed Lido, Ethereum, Solana, and Uniswap this year, making it one of the most profitable participants in the DeFi sector.

The decline in JTO’s value is attributed to regular token dilution. With 11.31 million JTO tokens released monthly until December 2026, the token’s supply continues to grow, putting downward pressure on its price.

JitoSOL: A liquid staking token users receive when staking SOL with Jito. It offers liquidity and higher staking yields (currently 9.81%).

Vault Receipt Tokens (VRT): A tokenized representation of staked assets used for restaking, allowing users to maximize their returns over time.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Dai

Dai  Litecoin

Litecoin  Polygon

Polygon  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Pepe

Pepe  Ethena USDe

Ethena USDe  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Aptos

Aptos  Stellar

Stellar  Monero

Monero  Maker

Maker  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Render

Render  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB  Mantle

Mantle  Arbitrum

Arbitrum  Renzo Restaked ETH

Renzo Restaked ETH  Immutable

Immutable  Sui

Sui  Injective

Injective  Optimism

Optimism