Table of Contents

This year, cryptocurrency-related ETFs have performed remarkably well Out of all the ETFs introduced this year, cryptocurrency-related ETFs have performed exceptionally well. This year, cryptocurrency-related ETFs have performed remarkably well

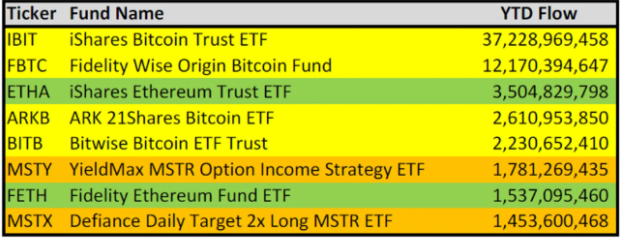

The CEO of ETF Store, Nate Geraci, wrote on his X (formerly Twitter) on the 30th (local time) that “of the 740 ETFs introduced this year, the top 8 are all cryptocurrency-related ETFs.”

In particular, there are two Ethereum spot ETFs, two MicroStrategy ETFs, and four Bitcoin (BTC) spot ETFs.

Frequently Asked Questions

Cryptocurrency-related ETFs are exchange-traded funds that provide investors exposure to cryptocurrencies like Bitcoin or Ethereum without requiring them to hold the actual digital assets. They may track the price of cryptocurrencies directly or invest in companies and projects within the crypto ecosystem.

The success of cryptocurrency-related ETFs can be attributed to growing interest in digital assets, advancements in regulatory clarity, and the introduction of Ethereum and Bitcoin spot ETFs, which have made crypto investments more accessible to traditional investors.

Spot ETFs directly track the price of the underlying cryptocurrency (e.g., Bitcoin or Ethereum) in real-time, offering a more accurate representation of their value compared to futures-based ETFs. This makes them attractive to investors seeking direct exposure to crypto assets.

According to Nate Geraci, the CEO of ETF Store, the top eight ETFs introduced this year include two Ethereum spot ETFs, two MicroStrategy ETFs, and four Bitcoin spot ETFs. These have outperformed other ETFs in 2024.

MicroStrategy ETFs invest in MicroStrategy, a company well-known for holding significant Bitcoin reserves. These ETFs allow investors to gain indirect exposure to Bitcoin through the performance of MicroStrategy’s stock. In contrast, Bitcoin or Ethereum ETFs directly track the performance of these cryptocurrencies.

Viral Topic

The market for cryptocurrencies on December 12,2024 || Crypto Shockwave || CoureX 5: Transforming Blockchain for Financial Empowerment

You can also read about cryptocurrency from our website.

myselfcrypto || insightbitmarket || truthofcrypto || buybitmarket || defidiary || tweetcrypto || cryptocosmosworld

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Dai

Dai  Litecoin

Litecoin  Polygon

Polygon  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Pepe

Pepe  Ethena USDe

Ethena USDe  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Aptos

Aptos  Stellar

Stellar  Monero

Monero  Maker

Maker  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Render

Render  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB  Mantle

Mantle  Arbitrum

Arbitrum  Renzo Restaked ETH

Renzo Restaked ETH  Immutable

Immutable  Sui

Sui  Injective

Injective  Optimism

Optimism