Strong DeFi Activity Causes Ethereum Fees to Reach a 9-Month High

Strong DeFi Activity Causes Ethereum Fees In the last week, Ethereum’s price fell 2.08% overall, which is consistent with how most cryptocurrencies have performed overall. Even though the well-known cryptocurrency is having trouble breaking out beyond $4,000, some changes on its underlying network have caught the interest of investors.

Ethereum Weekly Fees Increase 18% Amid the Growth of the DeFi Ecosystem

Crypto analytics firm IntoTheBlock said on December 13 that weekly Ethereum network fees increased 17.9% over the previous week to an estimated $67 million, the largest amount since April.

As Bitcoin fell back to $100,000, analysts at IntoTheBlock said that ETH’s price balancing was the reason for these hefty network fees. Furthermore, DeFi activity on the Ethereum blockchain has also increased. Strong DeFi Activity Causes Ethereum Fees

The Satoshi Club offers additional information about Ethereum’s thriving DeFi ecosystem, pointing out that traders are using their Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) to borrow stablecoins, a trend known as DeFi lending. By utilizing the liquidity and safety of DeFi protocols, these wrapped assets enable users to optimize their collateral utility while preserving exposure to well-known cryptocurrencies like Ethereum and Bitcoin. Strong DeFi Activity Causes Ethereum Fees

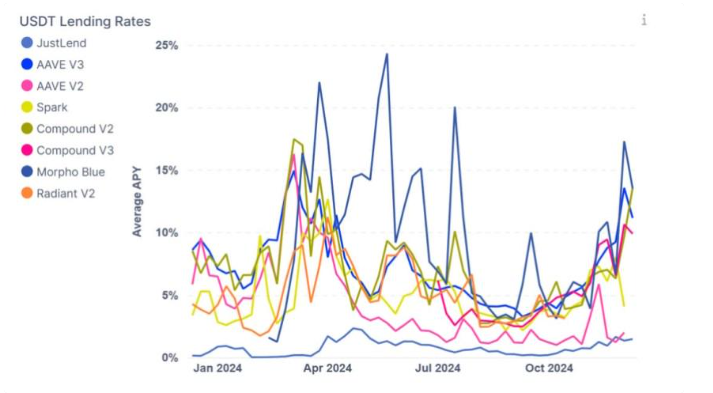

Notably, the spike in lending demand pushed interest rates to historically high levels, currently over 10% on average and up to 40% on some platforms. It’s interesting to note that these numbers reflect the peak dynamics of the bull market of 2022. Strong DeFi Activity Causes Ethereum Fees

With an astonishing $500 million in net inflows over the past week, Aave, one of Ethereum’s primary DeFi protocols with a TVL of $22.46 billion, has been a focal point of this increasing DeFi activity. Strong DeFi Activity Causes Ethereum Fees

Although greater DeFi activity may signal a rise in interest in the Ethereum network, investors should be aware that higher Ethereum fees will be difficult for smaller users and only beneficial for those who can profit from high interest rates Strong DeFi Activity Causes Ethereum Fees

Overview of ETH Prices

Ethereum is currently trading at $3,914.08, which is a slight decrease of 0.22% over the previous day. However, the altcoin’s remarkable performance over the last few weeks is reflected in its 21.39% increase on its monthly chart. Strong DeFi Activity Causes Ethereum Fees

As previously mentioned, the $4,000 price range, which has provided significant obstacle to price increase since the beginning of December, is Ethereum’s most imminent resistance. Ethereum is expected to soar to $4,900, its current all-time high and the next major price obstacle, if it can overcome this price barrier. Strong DeFi Activity Causes Ethereum Fees

Ethereum continues to be the second-largest cryptocurrency, accounting for 12.9% of the market for digital assets with a market valuation of $471.16 billion. Strong DeFi Activity Causes Ethereum Fees

Frequently Asked Question

Ethereum network fees increased by 17.9% in the last week, reaching $67 million. This rise is attributed to the growing activity in the decentralized finance (DeFi) ecosystem, including higher demand for DeFi lending and borrowing using Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH).

DeFi lending allows users to borrow stablecoins by collateralizing wrapped assets like WBTC and WETH. The surge in demand for borrowing has pushed interest rates to historically high levels, indirectly increasing network activity and transaction fees on the Ethereum blockchain.

Aave, a leading DeFi protocol on Ethereum, saw $500 million in net inflows last week, thanks to its ability to offer liquidity and safety while optimizing collateral utility. Its Total Value Locked (TVL) is currently $22.46 billion, reflecting the growing interest in DeFi platforms.

Ethereum’s price has been balancing below the $4,000 mark, with a slight 0.22% decrease in the past day but a strong 21.39% monthly gain. As more investors engage with DeFi protocols during periods of price consolidation, network fees tend to increase due to heightened activity.

Higher Ethereum fees benefit larger investors and users who can capitalize on elevated interest rates in DeFi lending. However, these fees pose challenges for smaller users, potentially limiting their participation in the network due to cost barriers.

Viral Topic

The market for cryptocurrencies on December 12,2024 || Crypto Shockwave || CoureX 5: Transforming Blockchain for Financial Empowerment

You can also read about cryptocurrency from our website.

myselfcrypto || insightbitmarket || truthofcrypto || buybitmarket || defidiary || tweetcrypto || cryptocosmosworld

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Dai

Dai  Litecoin

Litecoin  Polygon

Polygon  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Pepe

Pepe  Ethena USDe

Ethena USDe  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Aptos

Aptos  Stellar

Stellar  Monero

Monero  Maker

Maker  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Render

Render  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB  Mantle

Mantle  Arbitrum

Arbitrum  Renzo Restaked ETH

Renzo Restaked ETH  Immutable

Immutable  Sui

Sui  Injective

Injective  Optimism

Optimism